The property had been foreclosed on for back taxes by Ingham County Treasurer Eric Schertzing in 2014, when it failed to sell at a public auction. The church swooped in and bought it.

The excitement was shared by Lansing Economic Area Partnership — LEAP — which saw fixing up the old school as the linchpin for redeveloping the Holmes and Pleasant Grove Road area, long in despair. But the excitement soon gave way to the reality that the building was too big a challenge for the Pentecostal congregation. According to City of Lansing records, the church has not drawn any permits for construction on the property. Instead, it sits empty.

The $5,204 purchase price was misleading. The purchase also obligated the church to assume responsibility for the outstanding property taxes for 2014.

And the tax bill keeps growing. While the church is a nonprofit, rules for assessing taxes require the building to be in use, said Schertzing.

And now, Schertzing is preparing to foreclose on the property again. The church owes, as of Dec. 15, $73,545 in back taxes. That landed the property on Schertzing’s list of top 10 tax delinquents of 2017 in the seventh slot.

Church officials did not return a call requesting comment. Schertzing said there have been discussions with the church and city leadership regarding the property’ fate. He said Lansing Mayor Virg Bernero had worked with church leaders to “get a good outcome” for the property, but Schertzing himself was less optimistic.

“I didn’t think foreclosure was a bad thing,” he said, “because if they don’t have the money to keep it from being foreclosed, how are they going to find the money to redevelop it?”

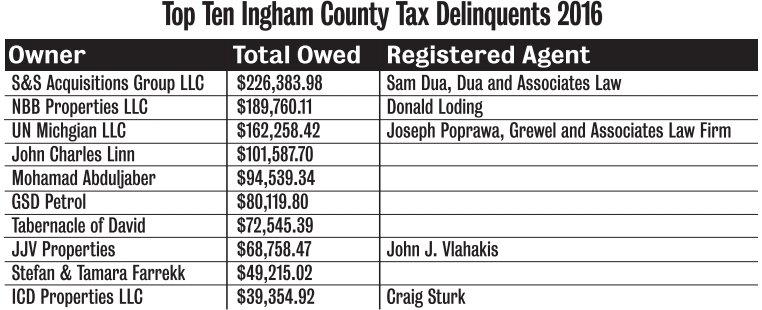

Others on the list include two individuals and a couple — John Linn of Williamston; Mohamad Abduljaber, who is serving time in federal prison for falsifying income tax returns and receiving kickbacks from health care payments; and Stefan and Tamara Farrell of DeWitt. The other six property owners are businesses. Together the top 10 tax delinquents owe the county nearly $1.1 million. (See complete list on this page.)

If the past due taxes are not paid off by March 31, the county has the legal right to seize the properties and sell them to recover the taxes.

Abduljaber was convicted, along with his wife, Dr. Shannon Wiggins, in 2014 in federal court in Grand Rapids. He was sentenced to three-and-a-half years in prison and is scheduled for release from the Loretto, Pa., federal correctional facility in September 2017. He was also ordered to pay over $750,000.

Federal authorities have said that while he owns the properties, the process of seizing them and selling them is not worth the effort. Records from the Ingham County Treasurer’s 0ffice show Abduljaber is the named owner of 25 properties, 20 of which have back taxes owed on them.

Linn, according to county documents, owns 18 properties in the county, and 17 of them are delinquent. The Farrells own 14 properties in the county, according to those documents from the treasurer, 11 of which are tax delinquent.

Topping the list is S&S Acquisitions Group LLC with a past due tax bill of $226,383, according to Schertzing. Sam Dua, the company’s representative, said it sent a check for $180,000 last week and plans to pay off the remaining delinquent taxes well before the March 31 deadline. Documents from the Treasurer’s Office show the company owns at least 65 properties in Ingham county, and 49 of those had back taxes on them.

Dua said while the tax debt appears large, it’s actually an indicator of the economic recovery after the 2008 housing bubble burst and the Great Recession hit the U.S.

“If you go back to the crash of 2008, the numbers were in the half-million-dollar range” in owed taxes,” he said. “If you look at it now, you see things are in recovery.”

He said the company had “been through this for several years,” but “we have never lost a property to tax foreclosure. In fact, we’ve bought properties from the tax sales.”

Number three on the list, UN Michigan, is the owner of the Magnuson Hotel on the city’s south side. It’s made headlines in the last year as the “Homeless Hotel.” The owner owes $162,258, according to Schertzing.

Joseph Poprawa, an attorney for the firm of Grewal and Associates, is the agent for UN Michigan. He said the owner was “horrified” at the situation the hotel found itself in last August. That’s when Homeless Angels was told the hotel was closing and the homeless families the group was housing in the hotel would have to find another place to live. That prompted Lansing Mayor Virg Bernero to declare a housing emergency. The nearly 100 residents were all relocated by the end of October.

But Poprawa said the back taxes are actually owed by Homeless Angels.

“This is kind of a weird situation,” he said by phone Tuesday. “It was being sold on a land contract and the purchaser defaulted on that.”

While he declined originally to identify the land contract purchaser, when asked if it was Homeless Angels, he confirmed it was.

The owner, Alvin Peh, is suing Homeless Angels and the City of Lansing in Ingham County Circuit Court.

Mike Karl, head of Homeless Angels did not return phone calls on Tuesday seeking comment.

However, Schertzing said , “No one has shown me that land contract. If they do, I’d be happy to add Homeless Angels to the actions.”

Support City Pulse - Donate Today!

Comments

No comments on this item Please log in to comment by clicking here